An Introduction to Swing Trading Options: Calls and Puts

Swing traders are constantly on the hunt for short-to-medium-term trades. The goal is to capitalize off of quick bursts in a stock’s price. And those with a particularly keen eye can get a big boost from swing trading options.

Swing traders are a special breed. Unlike day traders, they’re not glued to charts or constantly watching the ebb and flow of the markets. While day traders can be in and out of several positions in a single day, swing traders don’t have to meet as many stringent requirements. That’s simply because they won’t – by design – be making as many rapid trades. But there’s still a lot to pay attention to in order to be successful… especially when swing trading options.

Swing traders need to start out with a fixed plan. This takes emotion out of the equation. And for the record, emotions are like kryptonite for your portfolio. I can’t tell you how many traders I’ve seen hold onto a position well past its prime. And while they were waiting for that big upward break, their investment just continued to shed value.

But successful swing traders are known for a disciplined approach. And this starts with a strong evaluation of the risks and rewards of a given trade.

Most swing traders look to multiday chart patterns for guidance. When properly evaluated, this can lead to short- or medium-term wins simply by following a stock’s (or any type of security’s) momentum. Rapid swings in price that follow a pattern of some sort are a swing trader’s bread and butter.

When a stock follows a given chart pattern, investing in it can lead to quick gains. And swing trading options is a way to supercharge those gains.

How to Act on an Indicator

There are all sorts of indicators swing traders look for. No one pattern is necessarily superior to another – it comes down to what you’re looking for. And the more you look for a given pattern, the more adept you’ll become at finding it. And when you do find it, you’ll know exactly what to do.

Let’s start with a moving average. This is used to identify and determine the strength of a given pattern. Calculating a moving average is simple. You just note the security’s closing price over a given period of time, add up the total and divide by the number of days you’ve charted it.

This is one of the more common tools used in technical analysis. But that doesn’t make it any less valuable. When used properly, it can help determine the probability of a continuation of a given pattern… or even suggest when a reversal is imminent.

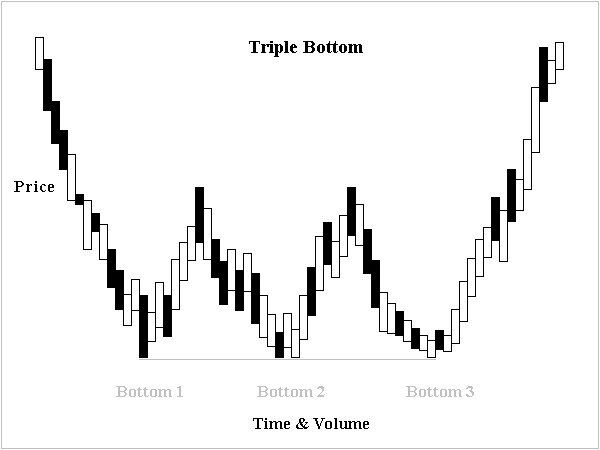

If, while calculating the moving average of a stock, you find a triple bottom pattern, this is seen as forecasting the reversal of a long downward trend. Here’s what that looks like:

When the stock price falls, trading volume increases at the lows. But there isn’t enough momentum at first to get over the hump. This pattern repeats multiple times. And after the third low, trading volume expands and pushes the stock past its resistance point.

When identified beforehand, this signals that a stock is poised to breakout. While buying the stock at the third low could lead to a quick profit, depending on the strength of the pattern, buying call option contracts can lead to an even bigger win.

Swinging Trading Options for the Fences

Because this is a strong indicator of a bullish move, someone swing trading options could look a month or so out for out-of-the-money (OTM) call options. This just means that the strike price of the option is above the current price of the underlying stock. This can be beneficial for two reasons:

- Out-of-the-money options have no intrinsic value. This makes them cheap. That being said, there is also a greater potential for total loss. But if the pattern is strong, it’s up to the investor to decide where the trade falls in their personal risk–reward matrix.

- Out-of-the-money options can offer the trader exceptional leverage if the stock moves in their favor. And while all options offer some form of leverage, the cheaper the options contract, the greater the possible gain.

If the underlying stock follows the pattern and those OTM call options are suddenly in the money, there’s no telling how much they could increase in value. Even a whopping 50% increase in value of the underlying stock would pale in comparison to the increased value of those options contracts.

When Bulls Turn Bearish

Not all chart patterns are built to identify upside potential. Some are designed to do just the opposite. Case in point: the head and shoulders pattern. This pattern has three distinctive peaks. It’s sort of like the triple bottom in reverse.

This indicator can often predict the reversal of a trend. And in most cases, this is when a good stock starts to do bad things… namely, drop in price.

Now, just because an investor sees a downward trend on the horizon doesn’t mean there isn’t money to be made. Just as call options are for investors who see upward potential, puts are for investors who see the underlying stock price falling.

There are two ways to go about this. If you believe in the company (despite its forthcoming price drop) this could be an opportunity to sell put options. If you want to own shares of the stock anyway, you could sell put options, collect the premium and then buy the shares when the contract is exercised.

But a cheaper way to go about it is to buy OTM put contracts. Again, these contracts will be relatively cheap. And if the stock price falls according to plan – to the point that the options are in the money – once again, that’ll fetch a handsome return on investment.

Swing Trading Options: The Bottom Line

Swing trading options comes with the reward of increased spoils. But it also comes with an increased risk of total loss – especially when dealing in OTM calls and puts. But for any swing trader, that’s a calculation they can only make for themselves.

If the rewards sound like they outweigh the risks to you, we highly recommend signing up for the free Trade of the Day e-letter below. As they say, you really only learn something by trying it. And the expert traders at Trade of the Day will offer all the guidance you need to get started trading quickly and efficiently.

Read Next: Swing Trading – What It Is and How to Do it

[adzerk-get-ad zone="245143" size="4"]About Matthew Makowski

Matthew Makowski is a senior research analyst and writer at Investment U. He has been studying and writing about the markets for 20 years. Equally comfortable identifying value stocks as he is discounts in the crypto markets, Matthew began mining Bitcoin in 2011 and has since honed his focus on the cryptocurrency markets as a whole. He is a graduate of Rutgers University and lives in Colorado with his dogs Dorito and Pretzel.