The Next Two Retailers to Get Crushed?

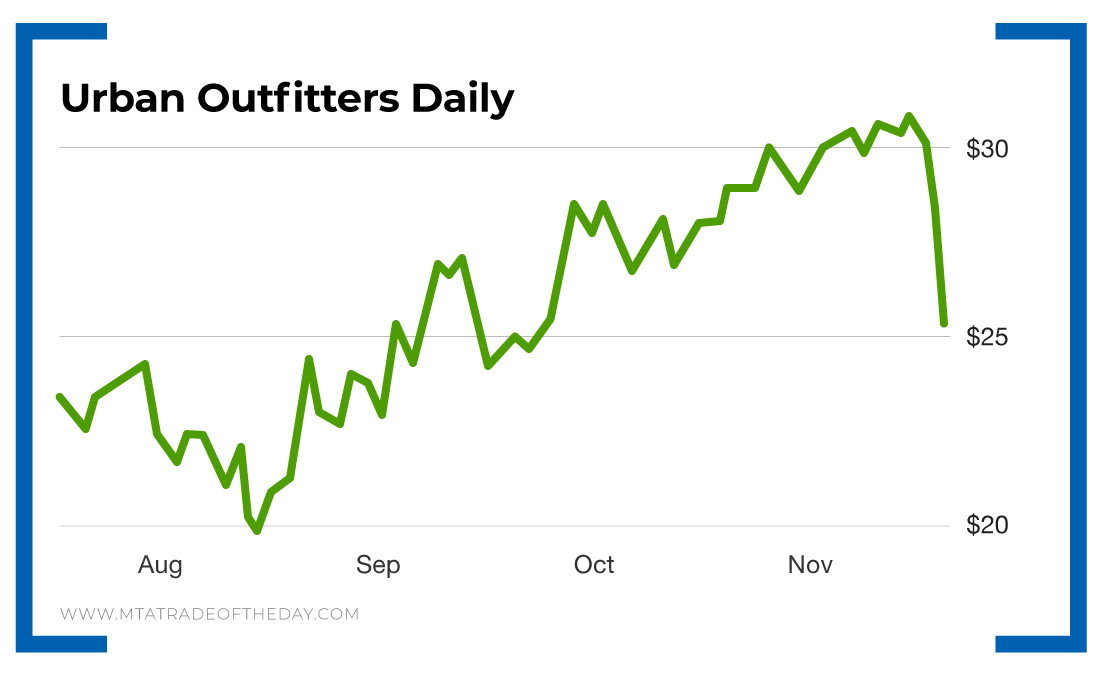

First thing this morning, War Room members were positioned to profit off the big downside move on Urban Outfitters (NASDAQ: URBN).

Going into this report, we knew that retail names were making big, big moves – both higher and lower. As traders, we wanted our members to profit off this trend.

Here was the setup…

On Tuesday, names like Home Depot and Kohl’s got hammered when their forecast earnings numbers were lower than expected.

But today, names like Target and Lowe’s blasted higher, beating the estimated earnings numbers.

Seeing these huge reactions – both up and down – we moved into a call-put combo on Urban Outfitters prior to its earnings release.

What attracted us to Urban Outfitters?

Well, as you may or may not know – the company has approximately 2,200 department and specialty stores worldwide under the Urban Outfitters and Anthropologie brands.

If you’ve ever been in one of these stores, then you know that the main attraction is its ’80s and ’90s wear – a lot of which is probably sitting in your parent’s attic right now.

The company caters to the 18 to 28 age group, for a heavily marked-up price.

It’s a fickle market. It’s also a very niche sector. And as such, it’s prone to big price fluctuations. In reaction to its last three earnings reports, Urban Outfitters moved 8%, 1% and 3%. The potential for a big move was setting up.

So we moved in…

War Room members paid a total of $2.65 for a call-put combo. And then, after the close yesterday, Urban Outfitters reported that its earnings came in at $0.56, which was down 20% from the same period last year and just below the Street’s consensus forecast of $0.57.

Revenues fell 1.4% to $987.5 million, which also missed analysts’ forecasts of $1 billion. On this news, shares of Urban Outfitters stock dropped 14% – exactly the move we were looking for!

Thanks to this downside reaction, members sold their call-put combo at $3.95.

Action Plan: With retailers under such an intense microscope right now, it’s clear that investors are either rewarding strong earnings with a big upside move – or punishing weak earnings with a big downside move.

Knowing this, we’ve identified two retailers that could be next in line to make a massive earnings move. One is restaurant Jack in the Box, and it reports earnings after the close today. The other is Macy’s, and it reports earnings before the open tomorrow.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.