Recent IPO Stands to Benefit From Upcoming Holiday Season

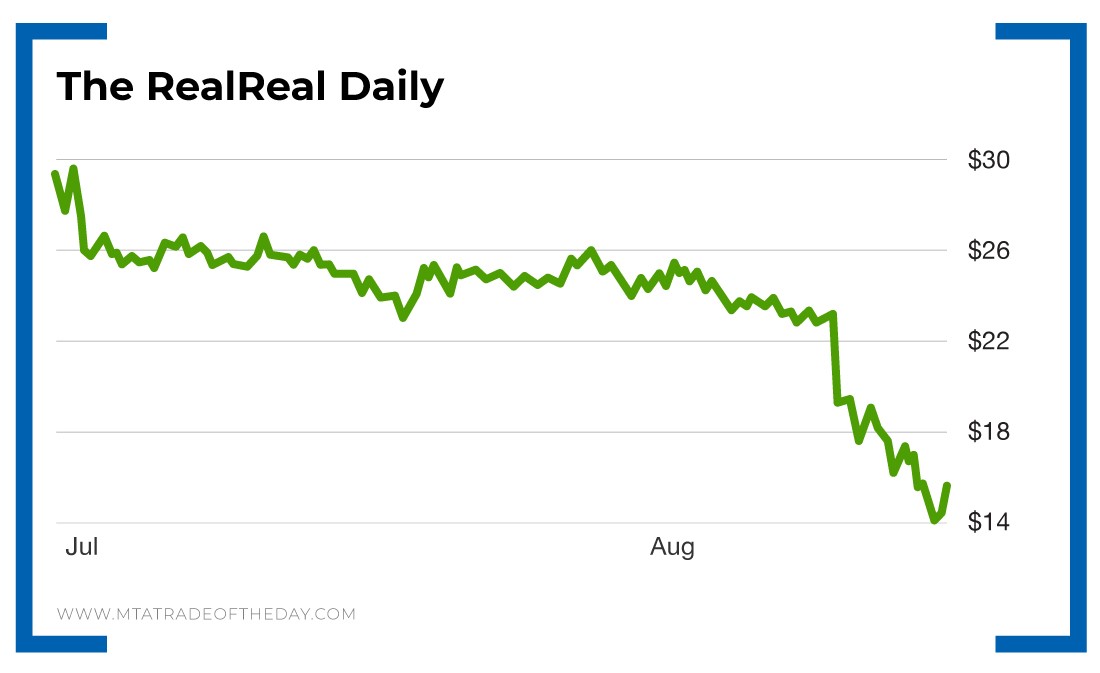

Yesterday, shares of The RealReal (Nasdaq: REAL) sold off sharply after the company reported earnings. The RealReal moved higher at the market open, up around 10%, then headed lower as the Dow Jones Industrial Average fell by more than 800 points.

The RealReal is a high-end consignment operation that has a huge online presence. The San Francisco-based company reported total revenue for the second quarter jumped 51% from a year earlier to $71 million, which was above the FactSet consensus forecast of $70.1 million. The company’s gross merchandise volume increased 40% to $228.5 million.

The company IPO’d at the end of June at $20 per share and quickly jumped to more than $28 as investors poured in.

On Wednesday, a lot of those investors got scared out of the stock. With small caps, investors are subjected to daily doses of volatility.

I often tell members that if you can’t handle a 5% intraday move with regularity, stay away from small caps!

The RealReal’s numbers were excellent before its shares dropped in value, but the market’s numbers were not. At the same time, Macy’s reported horrible numbers, putting pressure on the retail sector in general.

With this recent action, it’s clear that The RealReal is a compelling opportunity, mostly because people are unsure how to value it.

This company has no inventory to speak of. Its merchandise belongs to others. It acts as the middleman and takes a big cut of the sale – 30% to 50% to be exact. In return, it must provide the venue for sales online and a couple of high-profile showrooms to exhibit high-end jewelry.

Anyone can do this, right? What makes The RealReal so special?

The company has a unique model. The RealReal stands behind the authenticity of everything it sells. The online luxury consignment company does this by having an in-house staff of professional appraisers who guarantee the product and come up with a valuation for the seller.

It works. The seller gets to dispose of a high-end item that’s gathering dust, and the buyer gets a good deal on slightly worn clothing, shoes, jewelry and accessories – from luxury brands like Chanel and Gucci. Customers get these brands for an affordable price rather than paying the retail price, and they don’t have to worry about mistakenly buying a fake.

The RealReal is heading into the strongest part of the year – the holiday season. For such a new company, the valuation is harder to come by for buyers and sellers. And a short trading history makes it tough for technicians to make a call.

If you compare its metrics with those of other online retailers, The RealReal’s valuation based on sales and growth is reasonable, and the company is very well-capitalized. Its market cap is a shade over $1 billion, and the company is sitting on almost $400 million in cash.

[adzerk-get-ad zone="245143" size="4"]About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?