Toro Stock Forecast for Dividend Investors

The Toro Company (NYSE: TTC) has been a great company to invest in. It’s produced steady cash flows and has rewarded investors for decades. Going forward, the Toro stock forecast also looks promising.

To determine this outlook, I’ve looked at past trends and asked questions such as… Will past performance continue? Will Toro’s dividend continue to climb higher? And how safe is the dividend?

To get some insight here, let’s look at some highlights from my research. To start, we’ll look at the company and its future prospects. Afterward, we’ll dive into some of Toro’s dividend trends…

Also, after you’ve checked out the research below, you might consider testing out our free investment calculator. It shows how big your investments and portfolio can grow over time. Will it take three, five or 10 years to double your portfolio size?

Toro Stock Forecast and Company Highlights

The Toro Company has close to a $10 billion market cap. The company is based out of Bloomington, Minnesota, and has 9,300 employees. In 2019, Toro generated $3.14 billion in sales, and that works out to more than $300,000 per employee.

It’s been a tough year, but Toro has fared well. It sells a wide range of lawnmower and landscaping equipment. With more people staying at home, demand for its products has climbed. This has helped Toro stock and sales hit new highs.

Toro recently reported Q4 earnings of $0.84 billion, and total sales for the year came in at $3.38 billion. That’s up about 8% over the previous year. Going into 2021, analysts estimate that annual sales will grow to $3.6 billion.

That’s healthy growth, and investors have noticed. Toro’s stock price is up by more than 70% since its low in March of 2020. And over the last five years, shares have climbed about 160%. Keep in mind, though, that these returns don’t include dividends.

When including dividends, the total return would climb a little higher…

Toro Dividend History of Growth

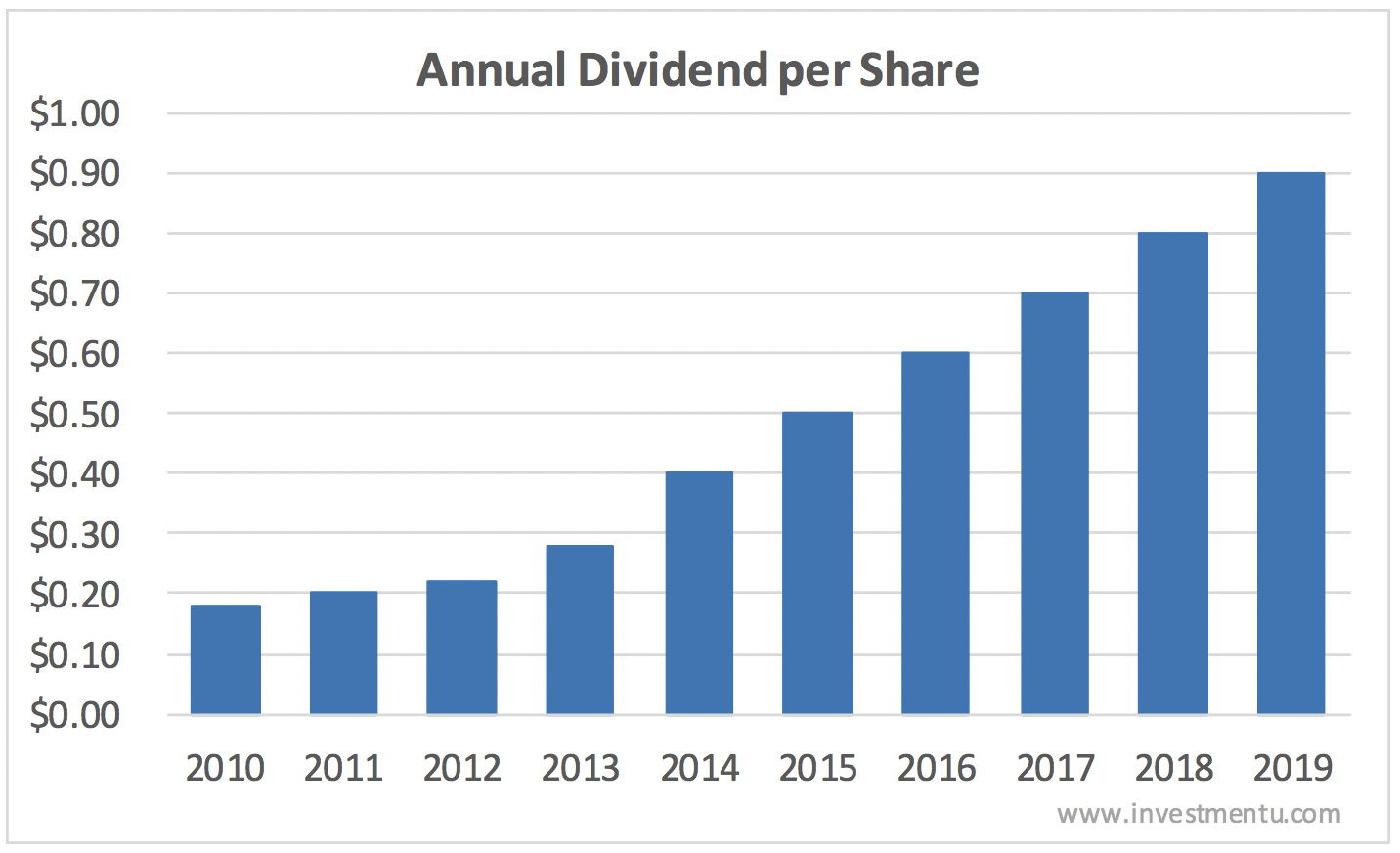

Toro’s dividend came in at $0.18 per share a decade ago. But over the last 10 years, the dividend has climbed to $0.90. That’s a 400% increase, and you can see the annual changes below…

The compound annual growth rate (CAGR) is 17.5% over 10 years, and over the last year, the dividend climbed 12.5%. The slowdown in dividend growth isn’t a great sign, but that’s still a hard rate to beat, especially in our low interest rate world.

Toro stock has been a solid income growth opportunity. And it still might be a good investment going forward. Let’s now take a look at Toro’s dividend yield…

Current Dividend Yield vs. 10-Year Average

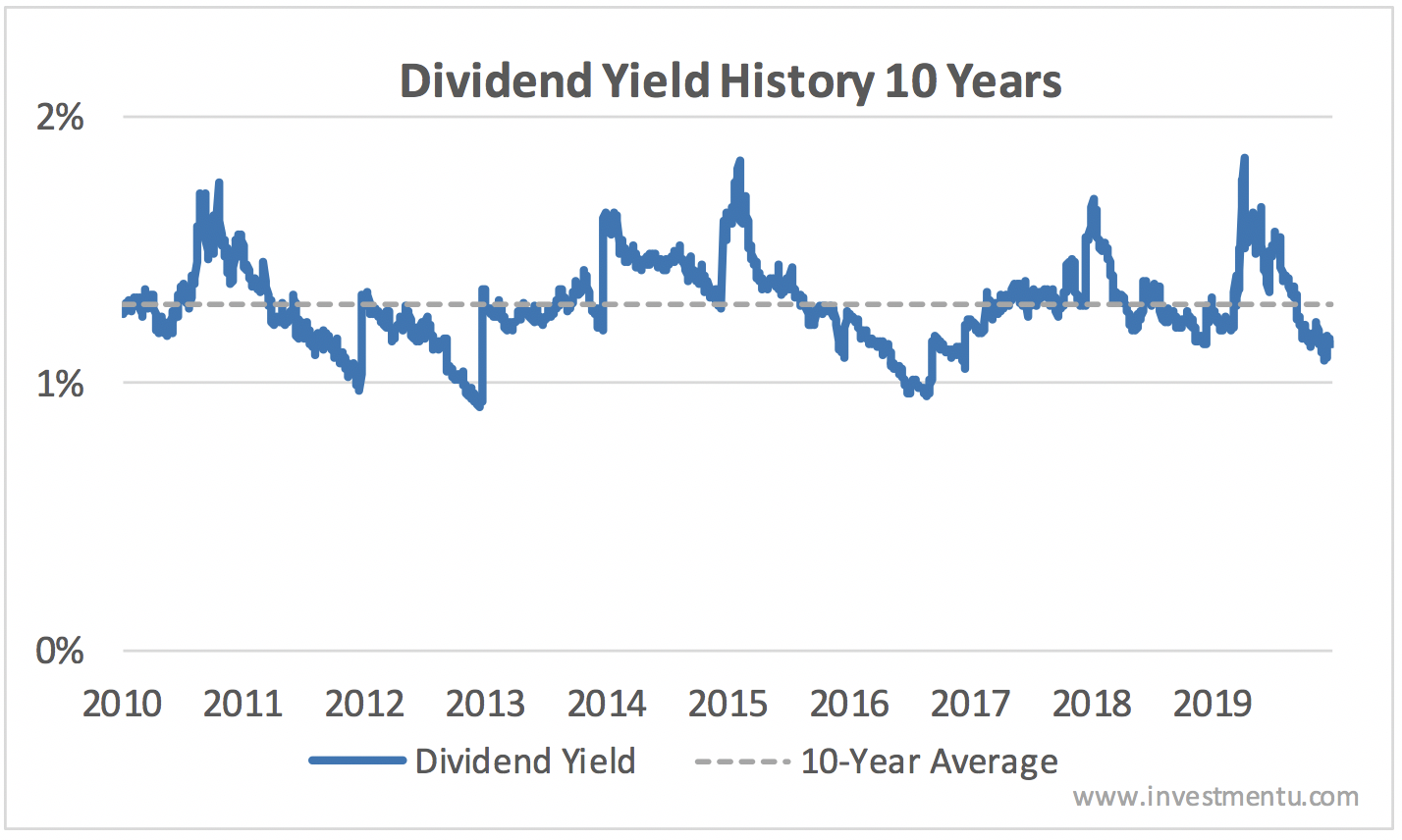

Toro has a long history of paying dividends, and that has made it one of the best dividend stocks around. This history also makes the dividend yield a useful value indicator. Generally, the higher the yield, the better it is for buyers. But payout sustainability is also vital, so we’ll look at that soon.

The dividend yield comes in at 1.15%, below the 10-year average of 1.29%. The chart below shows Toro’s dividend yield over the last 10 years…

As I’ve already shown you, investors have recently bid up the share price. And this has pushed the dividend yield down. Going forward, investors might be expecting higher growth and payouts. But more often than not, the dividend yield is reverting to the mean with share price changes.

Improved Dividend Safety Check

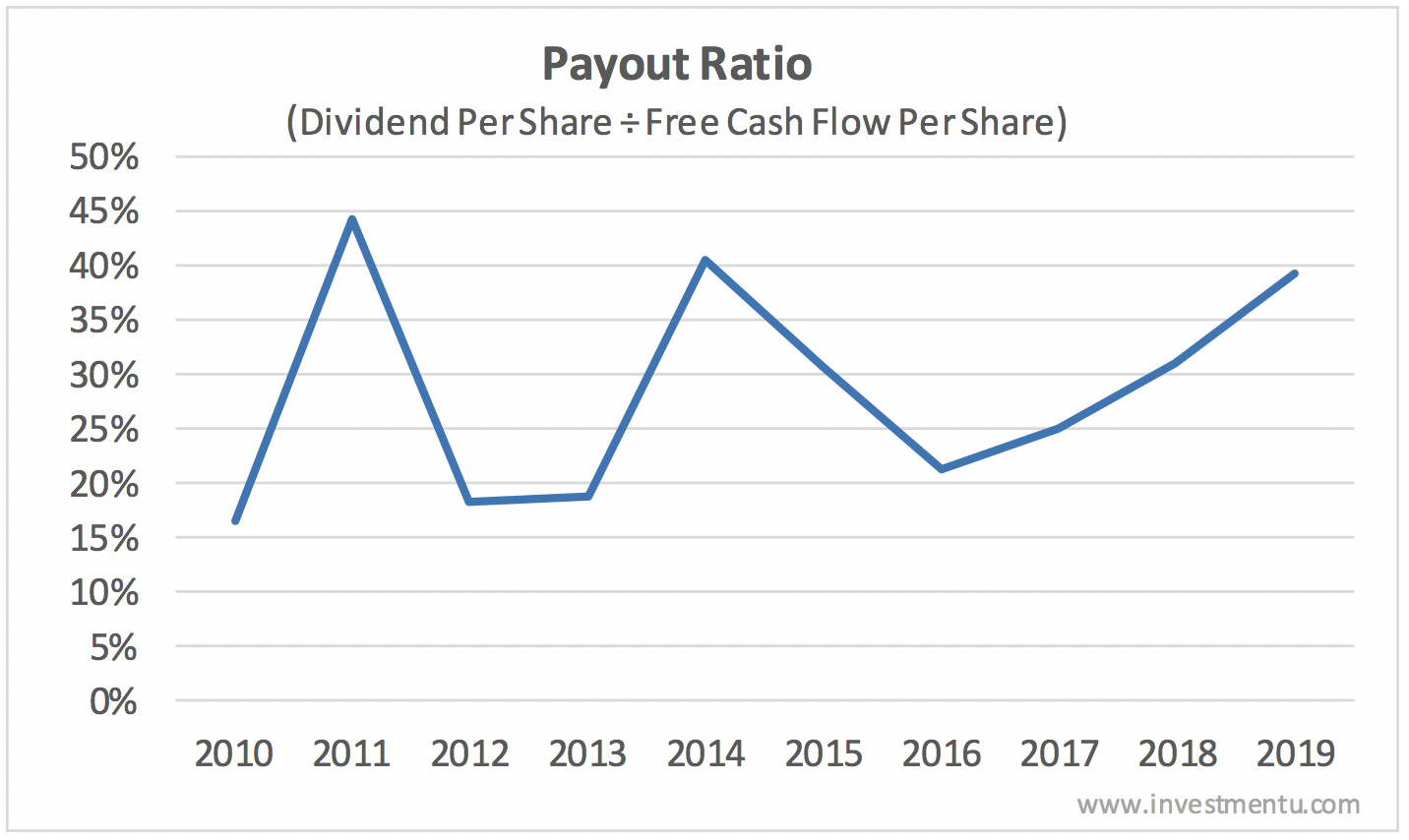

Many investors look at the dividend payout ratio for dividend safety. That’s the dividend per share divided by the net income per share. So a payout ratio of 60% would mean that for every $1 The Toro Company earns, it pays investors $0.60.

The payout ratio is a good indicator of dividend safety… but accountants manipulate net income. They adjust non-cash items such as goodwill. So instead, a better metric is free cash flow.

Here’s Toro’s dividend payout ratio based on free cash flow over the last 10 years…

The ratio is volatile over the last 10 years and the trend is up. However, every year comes in well below 50%. And this gives plenty of wiggle room for Toro’s board of directors to continue raising the dividend.

Overall, the dividend looks safe but the yield isn’t too enticing. With the recent run up in Toro’s stock price, a lot of gains have already come. This could easily continue as The Toro Company pushes sales higher, though.

For more investing research, consider signing up for our free Investment U e-letter below. It’s packed with tips and tricks from financial experts. Whether you’re new or already an experienced investor, there’s something for everyone. Also, don’t forget to check out this free investment calculator.

[adzerk-get-ad zone="245143" size="4"]