Trailing a $395,500 Bet in Shopify

In a previous Trade of the Day issue, we examined how we tracked a “Sharp Paper” buyer into Beyond Meat – which resulted in a winning trade.

Today, let’s do the same thing with Shopify (NYSE: SHOP).

Headquartered in Ottawa, Canada, Shopify offers cloud-based commerce platforms for small and medium-sized businesses in the United States, the United Kingdom, Canada and Australia.

The company’s platform gives merchants a single view of their business and customers across various sales channels. It enables store owners to manage products and inventory, process orders and payments, ship orders, build customer relationships, leverage analytics and reporting, and access financing.

Over the last 52 weeks, Shopify has been a Wall Street darling – gaining 118% (far outpacing the 12% gain on the S&P 500 over the same time frame).

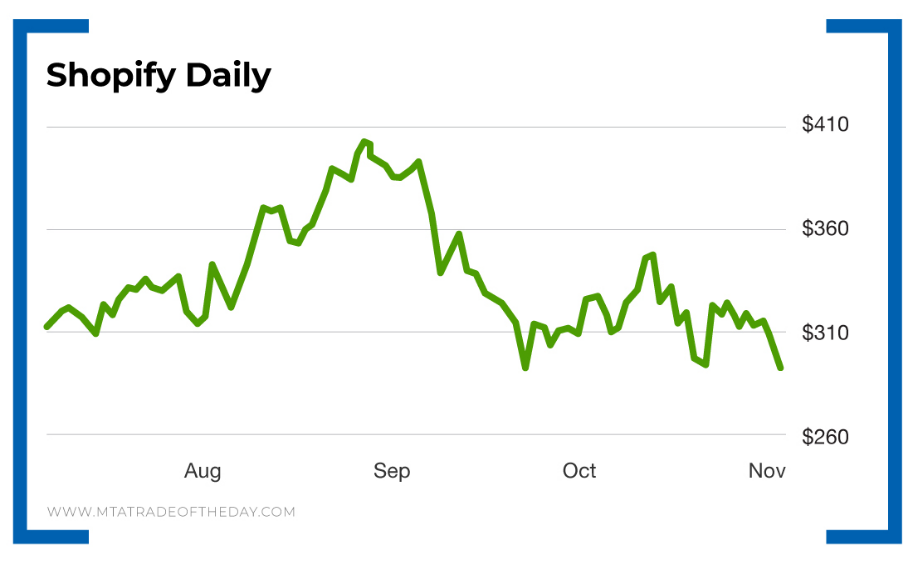

But lately, as you can see from the chart below, the stock has been trending lower…

Is this a time to buy shares at a reduced level?

According to one Sharp Paper buyer, that answer is no.

Here’s the story…

Last Thursday at 10:15 a.m., a Sharp Paper trader bought 300 of the Shopify November $300 puts – expiring this Friday – for $4.80 per contract.

Thirty minutes later, another transaction crossed the tape for 491 more of these contracts at $5 per contract.

All told, it was a $395,500 bet that Shopify would soon be moving even lower.

And so far, this Sharp Paper buyer has been right.

As of this morning, 1,400 of these contracts still remain in open interest. Only now, they’re worth $8 per contract.

Action Plan: It often pays off to track a Sharp Paper buyer like this – and follow their lead. It’s even more powerful tracking a Sharp Paper buyer who (so far) has been right!

Does Shopify have room to fall further?

Current support levels were tested – and held up – back in October. So you certainly could expect a bounce here. However, someone out there bought $395,500 worth of Shopify puts, which are now worth $632,800 – and they think it’s still going lower. For now, let’s continue to follow the lead of this Sharp Paper put buyer. You can follow along too by joining me in The War Room today!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.