Triangle Pattern Trading: Learn the Basics

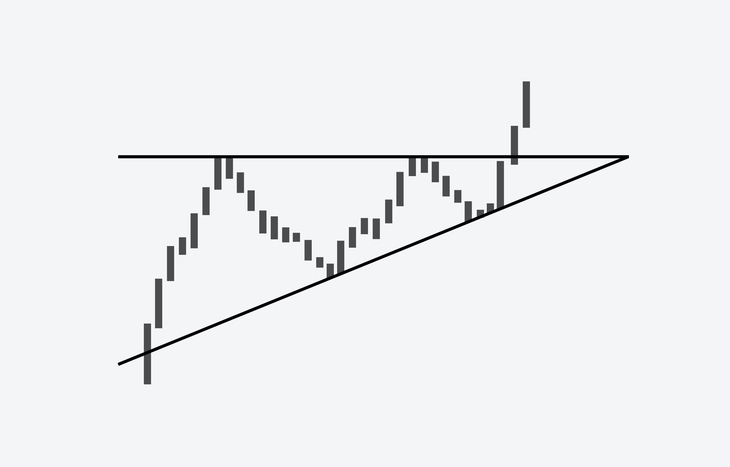

Triangle pattern trading is a strategy many day traders use to enter and exit their positions with confidence as prices stabilize. Triangles are a continuation pattern, meaning they’re not marked by a price reversal. In fact, the trend continues in the direction it was going. This is different from a wedge pattern in the sense that the price continues to rise or fall after the point of convergence.

Triangles are, best put, a type of support level within a trend. There’s a certain stabilization from the reduction in volume. After which, traders will enter or exit their positions – usually according to the previous trend line.

Recognize Ascending, Descending and Symmetrical Triangles

Like a wedge pattern, triangle pattern trading involves the convergence of support and resistance lines to an apex. Where wedges typically see a price reversal before the point of convergence, triangle patterns see a continuation of the trend after convergence.

There are three types of triangle patterns to trade, each with the same characteristics – yet each representative of a bullish, bearish or flat market.

- Bullish triangles see a quick upshot in price before establishing close resistance and support levels just off the peak. After the convergence of the triangle, the stock’s price continues to rise.

- Bearish triangles see the price of a stock trending down before establishing close resistance and support levels just off the bottom. After the convergence of the triangle, the stock’s price continues to fall.

- Symmetrical triangles lack upward or downward direction. There’s equal supply and demand for the security at its current price, and it continues to see relatively consistent resistance and support levels.

Triangles are easy to spot if you’re already looking for flags or wedges. Moreover, triangle pattern trading is often an easier strategy for new beginners because it’s a continuation trend. Spotting the beginnings of a triangle can allow investors to get into a position or take profits while recognizing the consolidation of volume occurring as the triangle forms.

Why Is the Triangle Pattern Important?

Triangles are an important representation of trading psychology. Because they occur most often after the dramatic rise or fall of a stock, they’re a good point of adjustment for traders who want to take profits or capitalize on the continuation. They’re an important stabilizing point that brings some credence and validity to a stock that may be taking off quickly. A triangle can act as a broader level of support in a stock’s meteoric rise or fall.

When a stock breaks the resistance or support level established by the triangle, it’s a sign in the confidence of buyers or short-sellers. This is why triangles are so important as a continuation pattern.

Common Mistakes in Triangle Pattern Trading

Triangles are closely aligned with volume. You want the volume to be heavy in the direction the price is moving. Without the volume behind it, a triangle runs the risk of “rolling over” at the point of convergence. That is, taking on the characteristics of a wedge pattern and reversing price instead of carrying on as a continuation pattern.

It’s also important not to get too aggressive in triangle pattern trading. Typically, the value in price from the first resistance level to the first support level is the value you can conservatively expect the stock to trend after breaking out. For example, if the difference between R1 and S1 is $8 and the share price is breaking out at $60, it’s reasonable to anticipate a target price of $68 on a bullish triangle or a bottom of $52 on a bearish triangle.

The Final Word on Triangle Pattern Trading

Recognizing patterns can help you build a promising portfolio for your future. If you want to get a head start on your retirement, sign up for the Wealthy Retirement e-letter below. The team at Wealthy Retirement provides tips and stock trends that may help you find the next big investment opportunity.

It’s important for everyday traders and long-term investors alike to recognize triangles and understand their significance as a continuation trend. Triangle pattern trading is an effective way to capitalize on a settling period in a stock that’s definitely trending high or low.

[adzerk-get-ad zone="245143" size="4"]