Two SpaceX Plays to Buy – Right Now

Over the weekend, Elon Musk said that the SpaceX Starship rocket is his top priority.

Furthermore, he stuck to his ambitious plan to launch the first Starships to Mars by 2022.

When I heard this news, I immediately thought two things…

First and foremost, the second SpaceX goes public, we want to be buyers of the stock – and traders of its options as well. I’m really excited because we all stand to make a fortune. So I cannot wait to own – and trade – SpaceX alongside you here in Trade of the Day (and also more frequently inside The War Room).

Secondly, this is great news for two publicly traded space plays.

So instead of waiting for SpaceX’s initial public offering (IPO), you can get exposure to space right now.

I’ll break both of them down for you below…

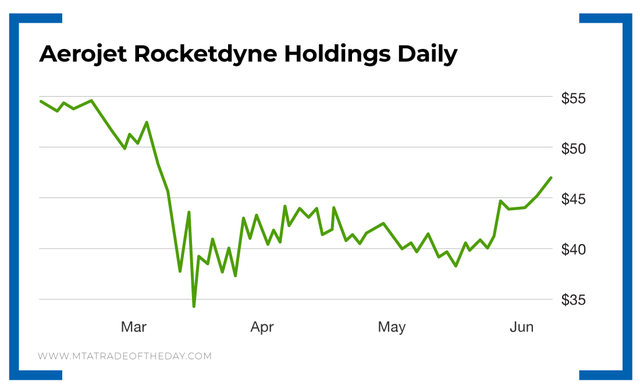

Play No. 1: Aerojet Rocketdyne Holdings (NYSE: AJRD)

This is the best pick-and-shovel stock for any and all space-related endeavors.

You see, Aerojet Rocketdyne Holdings makes the engines for the Space Shuttle. Its engines are also being used on Boeing’s Space Launch System rocket, United Launch Alliance’s Vulcan rocket and Northrop Grumman’s OmegA rocket. So clearly, when it comes to a rocket engine, Aerojet Rocketdyne Holdings is the top player.

The company is literally made up of rocket engine scientists with a long history pioneering early space missions.

Five of its engines powered the Saturn V for the Apollo 11 mission.

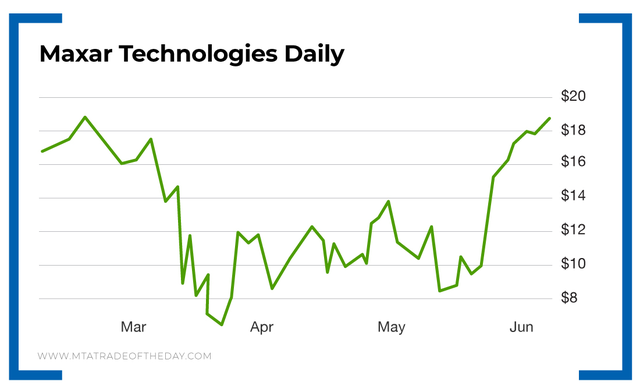

Play No. 2: Maxar Technologies (NYSE: MAXR)

This is a smaller play on satellites. Just recently, it was among a small group of 11 companies selected to build the first components of NASA’s Lunar Gateway space station.

Some of the other companies selected were Aerojet, Jeff Bezos’ Blue Origin, Boeing, Lockheed Martin, SpaceX and Northrop Grumman.

So clearly, Maxar is in some select company. It has decades of experience manufacturing “communication and Earth observation satellites,” with more than 280 of its satellites in orbit.

Action Plan: Why wait for SpaceX to IPO to start getting yourself positioned in space? Buy Aerojet Rocketdyne Holdings and Maxar Technologies today, and you’ll have exposure to the entire rocket engine and satellite market – and be fully covered. Both should have a place in your trading ledger at these levels.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.