Is Ulta Beauty Setting Up for a Q4 Run?

Is Ulta Beauty setting up for a Q4 run leading into the Christmas buying season?

Here’s the quick backstory…

Back on August 26, just ahead of Ulta Beauty’s earnings report, I set the table by telling War Room members this…

Going into the Ulta report on Thursday, it’s been one of the few retailers that has delivered consistent upside gains in the midst of this Amazon-dominated new world. Up 32% in 2019 (but down 7.5% so far in August), we could have a nice dip-buying opportunity leading into its earnings event. The last time Ulta tapped its 50-day moving average of $300 in April, it popped up to $360. Oppenheimer’s Rupesh Parikh says that Ulta is “one of the very few retail growth stories out there” – which is evident when you consider its 19% long-term earnings growth rate. With no debt and a 4% share repurchase program in the works, this may be one we play leading into earnings.

What was the result?

Ulta Beauty disappointed Wall Street – and got crushed.

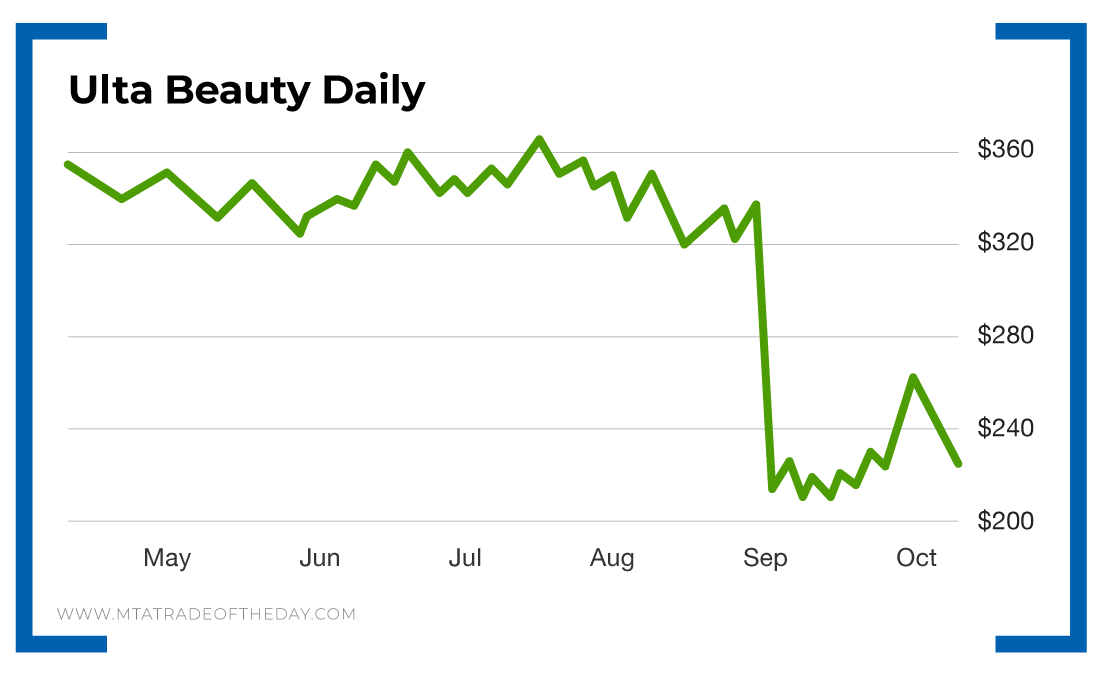

It fell from $360 to $226 in September.

But get this…

That’s when the insiders started buying.

On October 1, Karim pointed this out in The War Room…

Some interesting insider buys yesterday. Ulta – monster buying (more than $50 million).

I followed up with this…

A director at Ulta just bought 70,000 shares last week at prices ranging from $245.17 to $250 apiece – and totaling nearly $17.41 million. This came on the heels of another purchase of 173,800 shares in the previous week. Oh, and Goldman Sachs also initiated coverage of Ulta Beauty with its powerful “Neutral” rating (note sarcasm).

Action Plan: When you see insiders buying after a massive drop, it gives you an early clue that the downside move was overdone. That’s exactly what you see happening with Ulta Beauty right now. Today in The War Room, we identified a key support level – and members used that to hit a quick winner! While the gain wasn’t huge, the important part is that we’ve now identified a support level where the bulls can overpower the bears.

Most day-to-day traders have no clue about this support point. But in The War Room, we’ll be ready to buy anytime Ulta Beauty taps this level – which should result in an instant profit.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.