Understanding the Put Selling Strategy With Kirkland Lake Gold

It’s confusing, I must admit, when I tell people that I like to predict where a stock isn’t going to go…

You see, most people focus on one side of a trade. They want to know where a stock will go.

But that leaves out 50% of the possibility…

Let’s focus on both sides of the trade. After all, stocks do go up and down.

When I sell puts, this is the exact exercise I go through. I know where the stock is, and I can guess where it will or won’t go in the future.

What I do know for a fact is that there are three chances of winning using my particular put selling strategy and only one chance of winning if I’m making a one-way bet.

When selling puts, you are obligating yourself to buy the underlying shares if the stock drops below the strike price.

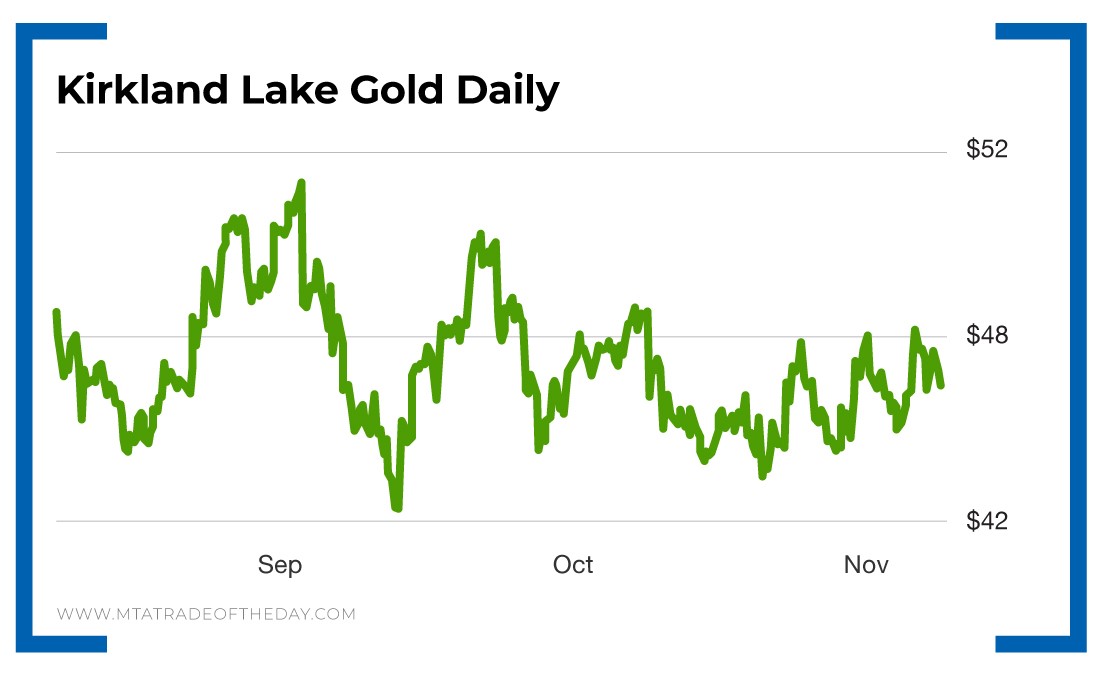

As a put sell example, I’ll use our recent War Room pick on Kirkland Lake Gold (NYSE: KL). Now, in fairness to current War Room members, I cannot give you the exact trade.

Kirkland Lake Gold is currently selling for $45.

You have a few choices here…

You could buy the shares or the call options at $45 and hope both go higher. You could buy a put option and hope it goes lower. Or you could sell a put option and win if it goes higher, lower or stays where it is, as long as it doesn’t go lower than your strike price.

So by selling a put, you have three shots at making a profit. The key to trading is to use a model that allows you to win and win frequently. The model I use delivered profits more than 90% of the time over the past two years. I was shooting for 80%, but I’ll take 90% any day!

My proprietary model considers several fundamental factors, a strict discount to market philosophy and a strict probability model. When all three line up, the chances of losing are very slim.

In the Kirkland Lake Gold example, what looked attractive was a way to own the shares at a 30% to 50% discount or make more than 30% just for trying. Think about it, you are being paid 30% to own something at close to half price.

So if the stock stays where it is, you will make 30%. If it goes up, you make 30%. And if it falls no more than 30% to 50%, you still make 30%…

It must plunge in order for you to lose, which is why it’s important to do this only on companies you want to own – that is the governing rule for put sellers.

War Room members did this play before earnings were released, and, as good companies do, Kirkland Lake Gold reported blowout earnings and raised its dividend. The shares moved higher, and the value of members’ puts moved lower.

Action Plan: When you sell puts, you want that value to move lower. We are now in the driver’s seat on a “low risk, high probability of profits” trade.

[adzerk-get-ad zone="245143" size="4"]About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?