What is APR (Annual Percentage Rate)?

Whether you’re applying for a credit card or calculating the expected return on an investment, three simple letters have significant bearing on your decision: APR. What is APR? It stands for annual percentage rate. It represents the amount of annual interest paid to investors or owed by borrowers. It’s a figure that includes costs and fees, but doesn’t take into account compounding. As a result, it’s a great baseline for comparing the worthiness of investments or the cost of different credit products.

In evaluating APR, borrowers and investors need to be cognizant of how it affects their wealth based on the principal balance. Here’s what you need to know about APR, as both an investor and a borrower.

APR For Investors

From an investment standpoint, APR represents the non-compounding rate of return for the year, expressed as an interest rate. For example, the APR of a bond might be 6%. That means you can expect to gain 6% on this investment each year.

APR is simple when comparing like-kind fixed-rate investment products, like bonds or certificates of deposit. These products are available at a specific face value, and come with an interest rate (coupon) that delineates their APR. In looking at the interest rate, investors can make smart decisions about where to put their money. For example:

Rashmit wants to invest in bonds. He’s choosing between a $5,000 bond with a 5% rate and a $3,000 bond with an 8% rate. Option A will net him $250 annually, while Option B will net him $240 annually.

This example illustrates the importance of principal on APR. Though Option B has a higher APR, the principal is smaller. Option A has a lower APR, but the return is higher due to the higher principal amount.

APR For Borrowers

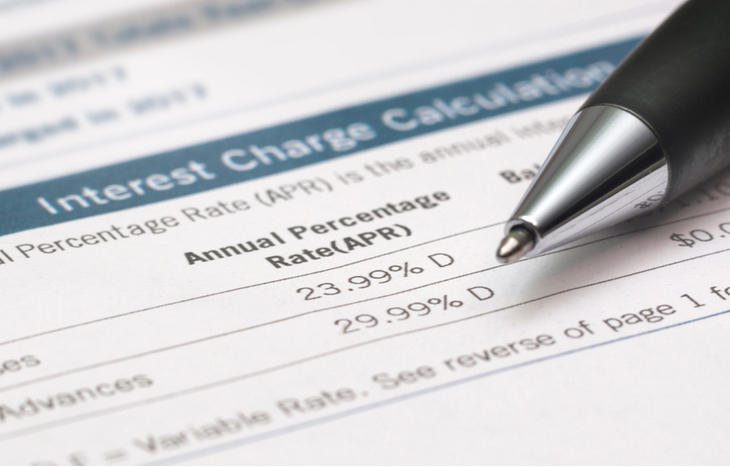

APR for borrowers is the same concept, only applied in reverse. You pay the APR to borrow money. This can be a huge range depending on the type of loan. For example, mortgage loans may be as low as 2.8% APR, while credit cards can average APR as high as 24%. It’s incredibly important to shop around for the best rate, to avoid paying significant interest rates when borrowing.

How APR works for borrowers is a bit complex. Take credit card APR, for example. Credit cards compound daily, using average daily balance. The formula for credit card interest is daily rate, times average daily balance, times days in billing cycle. The results of this equation can add up fast. For example, a $5,000 balance at a 24% APR would take 36 months to pay off if you pay $200 each month—and it will amount to $2,000 in interest payments!

APR for borrowers also takes several different forms: Purchase APR, Introductory APR, Penalty APR and Advance APR, to name a few. These are all APR that’s criteria-specific, which can change your evaluation of different financial products.

Fixed vs. Variable APR

Speaking of different types of APR, the biggest differentiator between them is often fixed vs. variable APR. As the name implies, fixed APR stays the same consistently for a predetermined period of time. Variable interest rates are, in a word, variable. They can rise or fall based on different factors, and usually between a specific range. Variable APRs adjust according to the prime rate, which can fluctuate often.

Both loan products and fixed-income investments can offer fixed vs. variable APR. It’s up to individuals to evaluate the products available to them and make a decision about which rate structure is ideal. For example, buying a home with a variable APR when rates are historically low can be a smart way to reduce total interest paid over the life of the loan. Conversely, an investor may prefer a fixed coupon bond with an attractive APR they can hold or resell for a premium.

APR vs. APY: What’s the Difference?

There’s often some confusion between annual percentage rate and annual percentage yield. The difference is that APR measures the annual rate sans-compounding, while APY represents the rate of return with compounding. The key difference to remember between APR and APY is that APY rises as the principal balance grows after each compounding. For example:

Marcy invests $1,000 in a fund that has a 12% APR. That means her monthly rate of return is 1%. If those earnings compound monthly, the APY actually comes out to 12.68%. This is because the principal balance rises monthly. The APR stays the same, APY changes.

Investors (and borrowers) need to know the difference between APR and APY because it affects the prospectus of an investment. In fact, the Truth in Savings Act of 1991 mandates that lenders and borrowers disclose both figures, so investors can make a sound decision.

Calculating Annual Percentage Rates

The formula for APR involves multiplying the periodic interest rate by the number of periods in a year. The formula for calculating APR is:

- Add interest paid over the duration of the loan to any additional fees

- Divide by the amount of the loan

- Divide by the total number of days in the loan term

- Multiply by 365 to find annual rate

- Multiply by 100 to convert annual rate into a percentage

Remember, this formula does not take into account compounding. To compute compounding into the equation, it’s important to calculate APY instead.

Pay Attention to Annual Percentage Rates

Whether you’re borrowing or investing, it’s important to pay close attention to APR. What is APR? It’s the annual interest generated by a principal balance. Beyond the rate itself, check to see if it’s fixed or variable, and what terms stipulate that rate.

To learn how you can use this knowledge to build wealth in your life, sign up for the Liberty Through Wealth e-letter below. The team at Liberty Through Wealth provides daily insights into investing and building toward financial independence.

APR can be a useful tool in evaluating financial products—you just need to make sure you understand it, and ensure that you’re comparing APR to APR, not to APY.

[adzerk-get-ad zone="245143" size="4"]