Why Zynga Stock Is Compelling Right Now

Today, I’d like to offer you something a little different…

You see, for many years, I’ve played Words with Friends, which is a form of Scrabble, developed by mobile video game publisher Zynga (Nasdaq: ZNGA).

I admit, it’s a fun game. It keeps me engaged while I’m stuck in an airport or in a doctor’s waiting room or really anytime I need to kill 10 minutes.

However…

For as long as I’ve known, Zynga stock has been dead money – despite the fact that it has a compelling game pipeline.

But lately, the company has been making some really impactful in-game improvements that have made its games even more “sticky.” In fact, I’ve found that I’m playing them more often – and I’m more engaged than ever before.

So… back in October when I heard that Zynga reported better-than-expected earnings results, achieving its best quarterly revenue number in its history, I wasn’t surprised.

Colin Sebastian of Baird said…

Zynga has done a good job creating a portfolio of [internet enabled] live services. It means that, with scale, it will lead to more profitability and more visibility.

It may seem silly, but ask yourself…

Will this new decade give birth to a new form of Roaring ’20s for mobile gaming technology?

In other words – have mobile gaming companies finally cracked the code to profitability and sustainability?

It’s worth asking… If you want to invest in companies that stand to benefit from innovations and that are finally starting to figure out how to become profitable mobile gaming platforms, then Zynga (trading for around $6.45 per share) doesn’t sound like a bad bet.

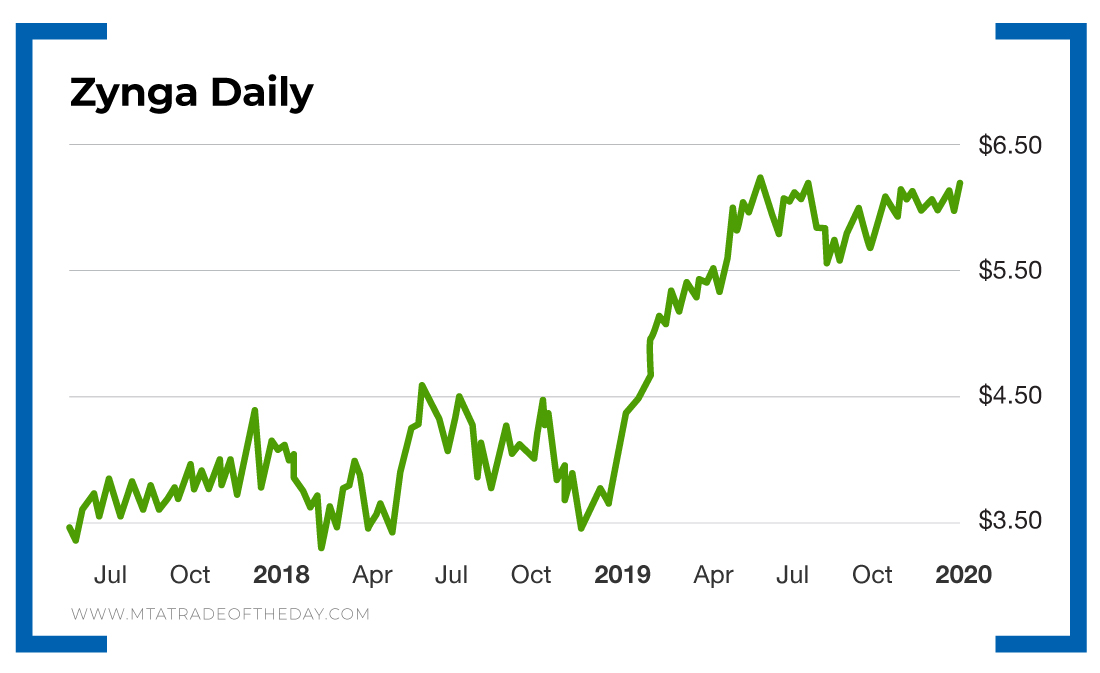

In fact, the company had a strong 2019 – going from $3.50 up past $6. But what sparked my interest was a bullish engulfing pattern last Friday. This was a strong pattern, especially in the midst of Friday’s selling pressure. To me, this could lend itself to a Long-Term Equity Anticipation Securities (LEAPS) opportunity.

Action Plan: While this is not quite how I typically trade in The War Room, I’m still bringing Zynga to your attention today – as I may go “out of the box” for a more longer-term trade. I’m thinking a January 2021 call.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.